OUR SERVICES

DOCUMENTATION

Elaboration of the mandatory transfer pricing documentation for the related-party transactions in line with the OECD Transfer Pricing Guidelines and the applicable Corporate Income Tax Regulations.

POLICY DEFINITION AND IMPLEMENTATION

Developing transfer pricing policies aligned with the value-chain of domestic and multinational groups, ensuring OECD Guidelines compliance globally. Expert advice in policy implementation and the effective management of internal procedures.

ADVANCED PRICING AGREEMENTS (APAs)

Let TPS assist you in designing, filing, and negotiating unilateral, bilateral, or multilateral APAs with tax authorities for your cross-border intragroup transactions, ensuring transfer pricing policy certainty and mitigating future tax risks and disputes.

DISPUTE RESOLUTION

Collaborating with your tax advisors, we help defend your transfer pricing position in audits, appeals, and Mutual Agreement Procedures. We elaborate expert reports regarding the valuation of related party transactions.

BENCHMARKING ANALYSIS AND COMPARABILITY STUDIES

At TPS, we conduct benchmarking and comparability analyses for TP documentation purposes, as per the OECD Guidelines. Ww assist our clients and collaboration partners in determining an arm's length range of returns using advanced economic analysis and comprehensive databases.

RISK ASSESSMENT

TPS can review your transfer pricing policies to ensure tax compliance, identify potential risks, and analyze the impact of the OECD/G20 BEPS Project measures, facilitating an alignment and optimization of such policies based on the business reality.

VALUATION SERVICES

Determination of the market value of economic assets and transactions based on the methods defined in tax and accounting regulations.

COUNTRY-BY-COUNTRY REPORTING (CBCR)

We assist our Clients in preparing their Country by Country Reporting (e.g Form 231) and identifying the criteria for the calculation of the magnitudes to report. At TPS, we can conduct a risk analysis based on the group's transfer pricing policy and its reported information.

OTHER SERVICES

We offer specialized transfer pricing services beyond our core offerings to address complex challenges and optimize your global tax strategy.

OUR INDUSTRIES

INSURANCE

HOSPITALITY

OUR INTERNATIONAL NETWORK

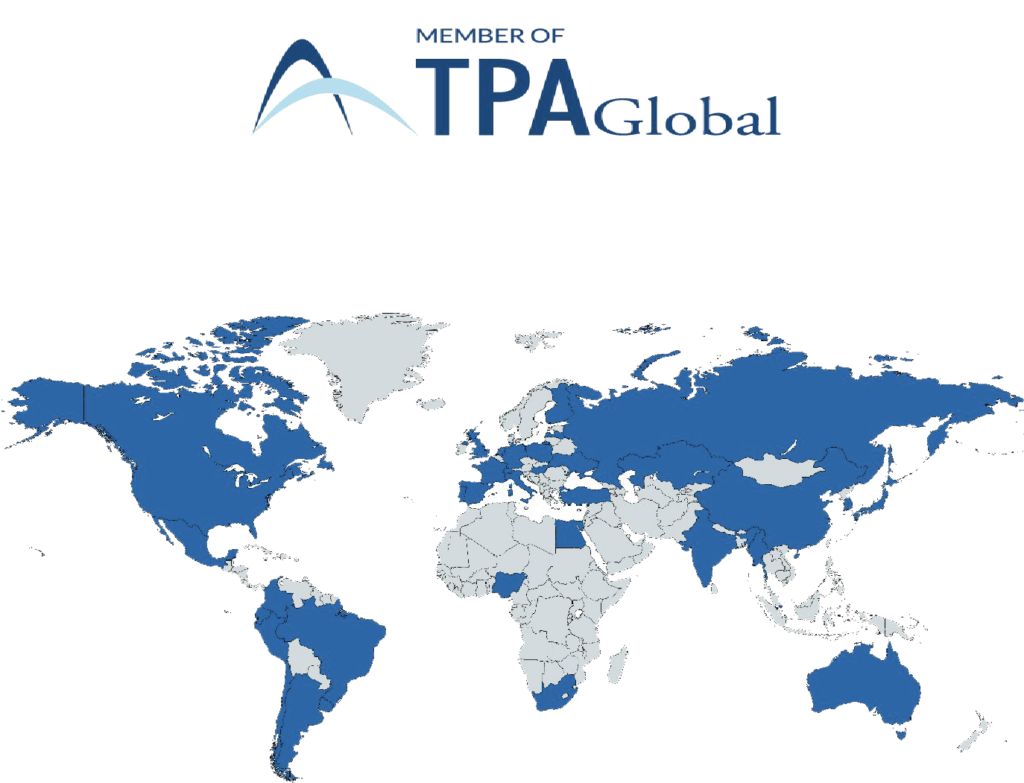

TPA GLOBAL

A network formed from a series of alliances between international firms that allows multinationals to access global solutions with a local focus on Transfer Pricing, due to its more than 400 professionals spread across 60 countries.

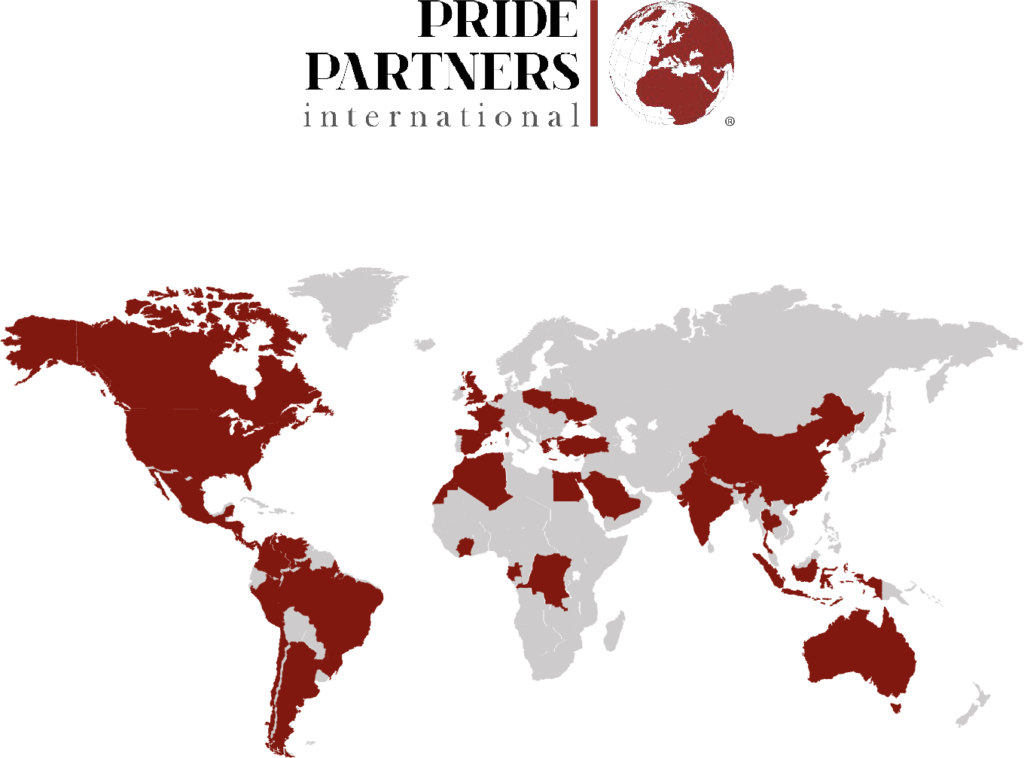

PRIDE PARTNERS INTERNATIONAL

A global association of transfer pricing and financial valuation consulting firms with a presence in most entrepreneurial markets around the globe.

IR GLOBAL

A multi-disciplinary professional service network that provides legal, accounting, and financial advice to companies and individuals around the world. IR Global is represented in more than 155 jurisdictions and covers over 70 unique practice areas.

COMMITMENT TO QUALITY & COMPLIANCE WITH DEADLINES

While we at TPS are expanding our network of offices to be able to continue to offer a coordinated and global service with local experts, we are also expanding our strong commitment to the quality of service we provide to our Clients.

In this regard, this year we have established a series of processes to prioritise needs, anticipate the requirements of the future and offer an exceptional service.

In addition to monitoring and continuously improving our customers’ satisfaction with the deliverables we prepare, we have strengthened teams to improve continuous interaction throughout the projects, exceed our previous results in meeting deadlines, and we have optimized several processes to improve efficiency. We are also revising and broadening our databases to be able to work with the best quality data available at all times.